In today’s fast-paced world, managing personal finances effectively is essential for individuals to achieve their financial goals and secure their future. This article explores Financial Cents, a comprehensive private finance management platform designed to empower individuals with financial planning, budgeting, tracking, and analysis capabilities.

What are Financial Cents?

Financial Cents is a user-friendly personal finance management platform enabling individuals to control their financial health. It is a digital hub where users can aggregate all their financial information, such as bank accounts, credit cards, loans, investments, and more, in one centralized location. The software platform helps individuals gain insights, make informed decisions, and achieve their financial goals by providing a holistic view of their economic landscape.

Keeping track of income, expenses, investments, and budgets can take time and effort. With Financial Cents, individuals can embark on a path toward financial success and build a solid foundation for their economic well-being. The platform comes into play to simplify this process and provide individuals with the tools they need to manage their finances efficiently.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 90

-

Feature and Functionality - 90

-

Customer Support - 95

-

Setup and Integration - 90

-

Value of Money - 95

User Review

4.59 (22 votes)Key Features and Functionalities

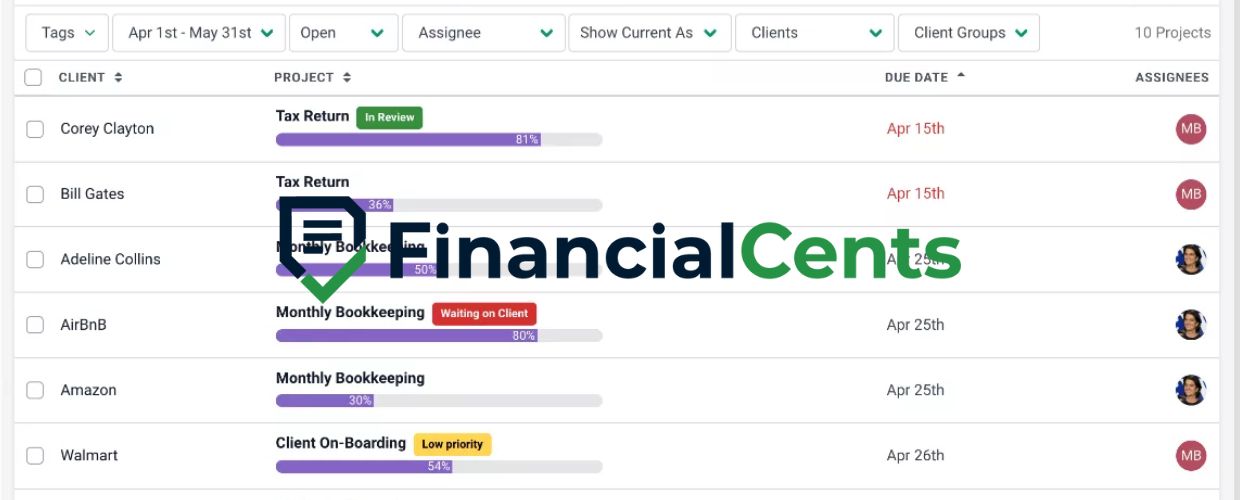

Financial Cents offers a range of features and functionalities to simplify personal finance management. Let’s delve into some of its key offerings.

Account Aggregation

The platform allows users to link their financial accounts, including bank accounts, credit cards, investment accounts, and loans. The platform securely pulls and consolidates data from these accounts, providing users a comprehensive overview of their financial situation. It eliminates the need to log in to multiple accounts separately and simplifies the tracking process.

Expense Tracking and Budgeting

Financial Cents enables users to track their expenses by categorizing transactions and setting budgets. Users can manually enter transactions or link accounts to import transactions automatically. The platform analyzes spending patterns, provides visualizations, and sends notifications to help users stay within budget and identify areas where they can save money.

Goal Setting and Monitoring

It allows users to set goals, such as saving for a down payment, paying off debt, or building an emergency fund. Users can track their progress toward these goals and receive personalized recommendations on how to achieve them. This feature helps individuals stay motivated, make necessary adjustments, and stay on track with their financial objectives.

Investment Tracking and Analysis

Financial Cents provides users with investment portfolio tools to track and analyze investments. Users can input investment holdings or link investment accounts to sync data automatically. The platform offers performance tracking, portfolio analysis, and insights to help users understand their investment performance and make informed investment decisions.

Bill Management

The platform simplifies bill management by providing reminders and tracking upcoming bill due dates. Users can set up bill payment alerts and keep track of their bill payment history. This feature helps individuals avoid late payments, save on fees, and maintain a good credit score.

Financial Insights and Reports

Financial Cents offers users valuable insights into their financial habits through interactive charts, graphs, and reports. Users can view their income, expenses, savings, and investments. These insights allow individuals to understand their financial behaviors better, identify trends, and make data-driven financial decisions.

Benefits of Financial Cents

Implementing Financial Cents can benefit individuals seeking to take control of their finances. Let’s explore some of these benefits.

Financial Organization and Clarity

The software platform provides a centralized platform to aggregate and manage all financial accounts in one place. The platform simplifies financial tracking, reduces paperwork, and gives individuals a clear and organized view of their financial situation.

Improved Financial Awareness

By tracking expenses, setting budgets, and monitoring progress toward financial goals, individuals become more aware of their spending habits and economic behaviors. This increased awareness helps users make informed decisions, prioritize spending, and save money effectively.

Enhanced Financial Planning

Financial Cents enables users to set realistic financial goals and provides tools and insights to track progress toward these goals. It enhances financial planning and encourages individuals to save, invest wisely, and make long-term financial decisions aligned with their objectives.

Streamlined Bill Management

With bill reminders and payment tracking features, Financial Cents helps users stay on top of their financial obligations. This streamlines bill management reduces the risk of late payments and associated fees, and contributes to building a positive credit history.

Investment Analysis and Optimization

The software platform offers investment tracking and analysis tools for users with investment portfolios. Users can monitor investment performance, identify areas of improvement, and make informed decisions to optimize their investment strategy.

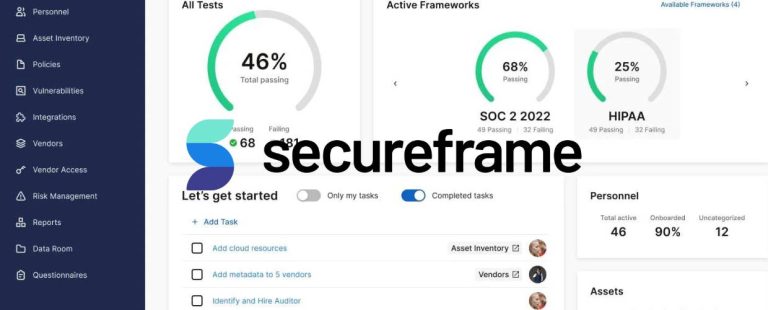

Data Security and Privacy

Financial Cents prioritize the security and privacy of user data. The platform employs robust security measures, including encryption protocols and secure data storage, to protect sensitive financial information from unauthorized access or breaches.

Conclusion

Financial Cents empowers individuals with the tools and insights they need to take control of their finances. With its comprehensive features, including account aggregation, expense tracking, budgeting, goal setting, investment analysis, bill management, and financial insights, the platform simplifies financial management, enhances financial awareness, and enables users to make informed financial decisions. By implementing Financial Cents, individuals can achieve financial organization, improve financial planning, streamline bill management, optimize investments, and gain peace of mind knowing they are in control of their financial future.