The mortgage industry is critical in the housing market, facilitating millions of individuals and families’ homeownership. In an era of digital transformation, Ellie Mae Inc. has emerged as a trailblazer, revolutionizing the mortgage industry with innovative technology solutions. With a focus on streamlining the mortgage process, improving efficiency, and enhancing the borrower experience, the software company has become a trusted partner for lenders, empowering them to thrive in a rapidly evolving landscape.

Company Overview and Commitment to Digital Transformation

Ellie Mae Inc., founded in 1997, is a leading provider of cloud-based software solutions for the mortgage industry. Headquartered in Pleasanton, California, the company has established itself as a driving force in digital mortgage transformation. The company aims to automate and simplify the mortgage process, enabling lenders to originate loans more efficiently, reduce costs, and deliver an exceptional borrower experience.

Digital Mortgage Solutions

Ellie Mae offers a comprehensive suite of digital mortgage solutions designed to streamline and automate every step of the mortgage origination process. Let’s explore some key areas where Ellie Mae’s technology empowers lenders:

Loan Origination System (LOS)

Ellie Mae’s flagship product, Encompass®, is a powerful LOS central hub for lenders, enabling end-to-end loan origination, processing, underwriting, and closing. Encompass provides a unified platform where lenders can efficiently manage loan files, collaborate with stakeholders, and automate manual tasks, ensuring a smoother and more efficient origination process.

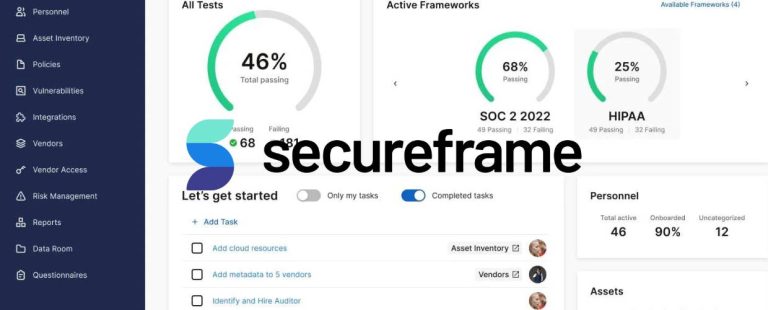

Compliance and Risk Management

Ellie Mae’s solutions include compliance and risk management tools that help lenders navigate the complex regulatory landscape. These solutions provide real-time compliance checks, automate disclosure generation, and facilitate audit readiness, minimizing compliance risks and ensuring adherence to industry regulations.

Automated Underwriting and Decisioning

Ellie Mae’s advanced underwriting and decisioning solutions leverage data and analytics to automate and streamline the underwriting process. These tools enable lenders to make accurate and consistent loan decisions, reduce manual efforts, and improve overall efficiency.

Digital Borrower Experience

Ellie Mae recognizes the importance of delivering a seamless and convenient borrower experience. Its digital solutions enable borrowers to complete applications online, securely upload documents, and track the status of their loans in real-time. Lenders can enhance customer satisfaction and differentiate themselves in a competitive market by providing borrowers with self-service tools and a user-friendly interface.

Driving Industry Innovation and Collaboration

Ellie Mae has fostered a culture of innovation and collaboration, actively seeking partnerships with industry stakeholders to drive continuous improvement. The company collaborates with lenders, mortgage brokers, appraisers, title companies, and other key players in the mortgage ecosystem to integrate their services and create a more connected and efficient workflow.

Ellie Mae actively engages with industry organizations and associations, participating in industry events, conferences, and working groups. The software company’s solutions align with evolving market needs and industry best practices by staying involved and seeking input from industry experts.

Commitment to Data Security and Compliance

As a provider of cloud-based mortgage solutions, Ellie Mae strongly emphasizes data security and compliance. The company employs robust security measures to protect borrower data, including encryption, access controls, and regular security audits. The software company also complies with industry regulations, such as the Gramm-Leach-Bliley Act (GLBA) and the Consumer Financial Protection Bureau (CFPB) regulations, to safeguard sensitive borrower information and ensure data privacy.

Conclusion

Ellie Mae Inc. is at the forefront of revolutionizing the mortgage industry through innovative technology solutions. Empowering lenders with advanced digital mortgage tools streamline the origination process, enhances efficiency, and improves the borrower experience. As the mortgage industry continues to embrace digital transformation, its commitment to innovation, collaboration, and data security positions it as a trusted partner for lenders seeking to navigate the evolving landscape successfully.

With its focus on automation, compliance, and borrower-centric solutions, Ellie Mae is redefining how mortgages originated and providing lenders with the tools they need to thrive in an increasingly digital world. As the housing market evolves, Ellie Mae remains committed to driving industry innovation and empowering lenders to achieve operational excellence and deliver exceptional customer experiences.