In today’s complex and ever-evolving business environment, regulatory compliance has become critical to conducting business responsibly and ethically. Organizations face an array of laws, regulations, and industry standards that they must adhere to to avoid legal consequences and reputational damage. This article delves into the importance of compliance risk assessment, its key components, and its role in safeguarding organizations from potential legal and financial pitfalls.

Understanding Compliance Risk Assessment

Compliance risk assessment is a proactive approach that assists organizations in evaluating their adherence to relevant laws, regulations, and industry standards. It involves identifying potential risks that could arise from non-compliance. It consists in conducting a comprehensive review of applicable laws, regulations, and industry guidelines relevant to the organization’s operations. Risk identification may also include analyzing past compliance incidents and identifying areas where the organization is particularly susceptible to compliance failures. Compliance risk assessment is a systematic process that helps organizations identify, research, and manage potential compliance risks.

Critical Components of Compliance Risk Assessment

When it comes to compliance risk assessment, several vital components need to be taken into consideration. One of the most important is identifying the specific regulations and laws that apply to the organization and its industry.

Risk Identification

The first step in compliance risk assessment is identifying potential risks that could arise from non-compliance. It involves comprehensively reviewing applicable laws, regulations, and industry guidelines relevant to the organization’s operations. Risk identification may also include analyzing past compliance incidents and identifying areas where the organization is particularly susceptible to compliance failures. During this phase, it is essential to involve subject matter experts, legal counsel, and compliance professionals to ensure a comprehensive understanding of the regulatory landscape. Organizations can use risk assessment frameworks and checklists to identify compliance risks across various business functions methodically.

Risk Analysis

Once risks are identified, the next step is to analyze them based on their potential impact and likelihood of occurrence. High-impact and high-likelihood risks require immediate attention and robust mitigation strategies. Risk analysis involves qualitative and quantitative assessments to prioritize risks based on their severity and potential consequences. Quantitative analysis involves assigning numerical values to risks based on potential financial loss, regulatory fines, or reputational damage. Qualitative research, on the other hand, evaluates risks subjectively, considering factors like public perception, brand value, and potential harm to stakeholders.

Controls and Mitigation Strategies

After identifying and analyzing compliance risks, organizations must develop appropriate controls and mitigation strategies. These measures may include updating policies and procedures, enhancing training programs, implementing monitoring systems, and conducting internal audits to ensure ongoing compliance. Controls should be designed to address specific compliance risks and prevent or detect potential violations. They should be practical, enforceable, and tailored to the organization’s risk profile. Additionally, controls should be periodically reviewed and updated to keep pace with changing regulatory requirements.

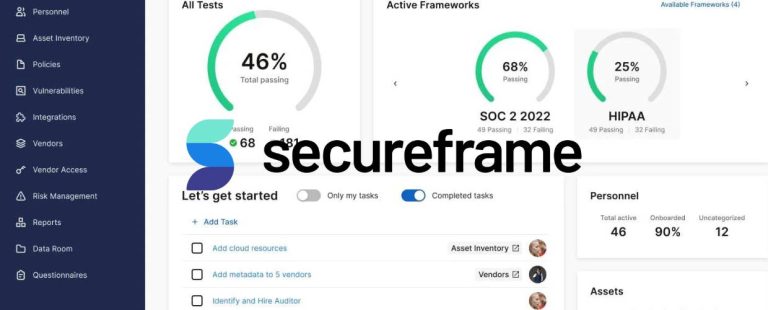

Monitoring and Reporting

Compliance risk assessment is an ongoing process, and organizations must continuously monitor and evaluate their compliance efforts. Regular reporting on compliance risk status to relevant stakeholders, including senior management and board members, ensures transparency and accountability in the compliance management process. Monitoring may involve conducting periodic compliance audits, tracking key performance indicators (KPIs) related to compliance, and implementing whistle-blower mechanisms to encourage reporting potential compliance issues. Regular reporting allows organizations to identify trends and patterns, enabling proactive risk mitigation.

Compliance Culture and Training

Creating a strong compliance culture within the organization is essential for effective risk management. Ensuring that employees at all levels understand the importance of compliance and receive regular training on relevant regulations and ethical conduct helps foster a culture of compliance and reduces the likelihood of compliance failures. Training programs should be tailored to specific roles and responsibilities and cover not only legal requirements but also the organization’s internal policies and values. An engaged and well-informed workforce is more likely to identify and report potential compliance risks, fostering a culture of ethics and compliance throughout the organization.

Importance of Compliance Risk Assessment

Compliance risk assessment is critical for organizations in ensuring they meet legal and regulatory requirements while promoting ethical behavior and responsible corporate citizenship.

Legal and Financial Protection

Compliance risk assessment helps organizations identify and address possible compliance issues before escalating into legal disputes or financial penalties. Organizations can avoid costly litigations and regulatory fines by proactively managing compliance risks. Furthermore, it protects the organization’s assets and financial stability by preventing non-compliance-related losses.

Reputation Management

Compliance failures can severely damage an organization’s reputation. A well-executed compliance risk assessment ensures that the organization operates ethically and responsibly, earning the trust of customers, partners, and the public. A positive reputation built on ethical conduct can lead to increased customer loyalty and enhanced brand value.

Strategic Decision Making

Organizations can create informed decisions that align with their risk appetite and long-term objectives by understanding the compliance risks associated with different business strategies. Compliance risk assessment assists in striking a balance between risk and reward. It helps decision-makers identify potential legal and reputational consequences of various strategic options, enabling them to choose the most appropriate path forward.

Competitive Advantage

Organizations that prioritize compliance and actively manage compliance risks gain a competitive advantage. Compliance-minded customers and partners are likelier to engage with organizations prioritizing ethical conduct and regulatory compliance. Such organizations are also more attractive to investors, who seek companies with robust risk management practices and a commitment to ethical business practices.

Enhanced Governance

Compliance risk assessment strengthens corporate governance by ensuring the organization has robust compliance controls and reporting mechanisms. It, in turn, fosters transparency and accountability at all levels of the organization. When senior management and the board prioritize compliance, it sets a tone of integrity and responsibility that permeates the entire organization.

Conclusion

Compliance risk assessment is integral to an organization’s risk management framework. Organizations protect themselves from legal, financial, and reputational harm by systematically identifying, analyzing, and mitigating compliance risks. Embracing a proactive approach to compliance risk assessment ensures adherence to relevant laws and regulations and fosters a culture of ethics, transparency, and responsible business conduct.

With the dynamic regulatory landscape continuously evolving, organizations prioritizing compliance risk assessment position themselves for sustainable success in a highly regulated world. By constantly monitoring and adapting to regulatory environment changes, organizations can confidently navigate the complex compliance landscape, ultimately contributing to their long-term growth and organizational success.