Compliance and risk management are intertwined pillars in business operations that safeguard organizations from potential threats and ensure responsible Conduct. Compliance entails adherence to laws, regulations, and industry standards, while risk management involves identifying, assessing, and mitigating potential risks that could impact the organization. This article explores the vital relationship between compliance and risk management, their shared objectives, and how their synergy enhances organizational resilience and ethical behavior.

The Interdependence of Compliance and Risk Management

Compliance and risk management are not isolated practices but interconnected disciplines that reinforce each other. Their relationship can be summarized as follows.

- Identification of Compliance Risks: Risk management processes help identify potential compliance risks by assessing internal and external factors that may impact the organization’s ability to meet regulatory requirements. Through risk assessments, organizations can identify areas where non-compliance may occur and take proactive measures to address these vulnerabilities.

- Risk Mitigation through Compliance: Compliance practices provide a framework to mitigate identified risks by enforcing policies and controls that align with laws and regulations. By incorporating risk management insights into compliance strategies, organizations can effectively prioritize actions to address high-risk areas.

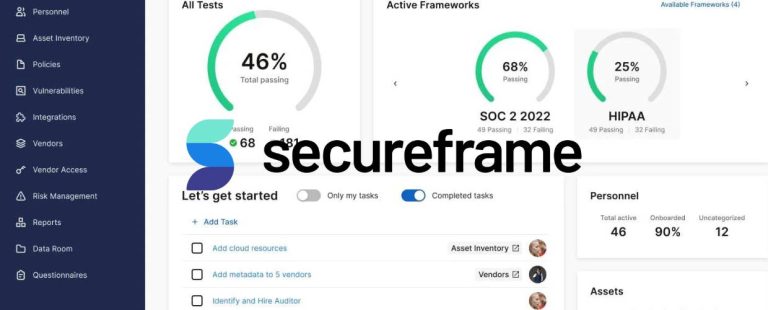

- Monitoring and Reporting: Risk management activities include continuous monitoring and reporting on compliance status, ensuring that the organization adheres to relevant requirements. Regular reporting informs stakeholders about the organization’s compliance efforts and risk exposure.

- Ethical Considerations: Both compliance and risk management prioritize ethical considerations, fostering a culture of responsible behavior and integrity within the organization. Ethical Conduct is a legal obligation and a risk mitigator, as it reduces the likelihood of compliance failures and repercussions.

Shared Objectives of Compliance and Risk Management

Regarding compliance and risk management, several shared objectives are crucial to success. Both observation and risk management aim to protect the organization from legal and financial harm while ensuring that the company operates ethically and responsibly.

- Safeguarding Stakeholder Interests: Compliance and risk management aim to protect stakeholders’ interests, including investors, customers, employees, and business partners. Organizations safeguard stakeholder interests and trust by ensuring compliance with laws and regulations and proactively managing risks.

- Ensuring Legal and Regulatory Adherence: Both disciplines strive to provide the organization complies with applicable laws, regulations, and industry standards, reducing the risk of legal penalties and reputational damage. Compliance efforts are often designed to align with specific rules, and risk management helps identify gaps in compliance and potential consequences of non-compliance.

- Minimizing Potential Losses: Risk management seeks to minimize potential financial, operational, and reputational losses that may arise from non-compliance with regulations or unanticipated risks. Compliance efforts aim to prevent compliance failures that could result in costly consequences.

- Building Organizational Resilience: Compliance and risk management strengthen an organization’s ability to withstand challenges and adapt to changing circumstances, fostering long-term resilience. A resilient organization is better equipped to navigate uncertainties and emerge stronger from adverse events.

The Synergy of Compliance and Risk Management

The synergy of compliance and risk management lies in their shared objectives of protecting the organization and promoting a culture of transparency and accountability.

- Proactive Risk Identification: Compliance practices provide a structured approach to identify potential risks associated with non-compliance, enabling early risk detection and mitigation. Organizations can address potential issues by integrating risk identification into compliance processes before they escalate.

- Risk-Based Compliance Strategies: Risk management helps prioritize compliance efforts based on the severity and likelihood of potential risks, ensuring efficient resource allocation. Organizations can allocate resources effectively and address critical compliance concerns by focusing on high-risk areas.

- Ethical Conduct as a Risk Mitigator: Ethical behavior, promoted through compliance practices, is a potent risk mitigator, as it reduces the likelihood of non-compliance and related repercussions. Organizations with a robust ethical culture are less likely to engage in risky behavior that could lead to compliance failures.

- Crisis Preparedness: Compliance and risk management jointly prepare organizations to respond effectively to crises and unforeseen events, minimizing their impact on the organization. By integrating crisis management strategies into compliance and risk management frameworks, organizations can respond swiftly and decisively to emergencies.

- Continuous Improvement: Compliance and risk management involve ongoing assessment and improvement, fostering a culture of learning and adaptability within the organization. Organizations can stay ahead of emerging risks and changing regulatory landscapes by continuously evaluating compliance processes and risk management strategies.

Benefits of Integrating Compliance and Risk Management

Integrating compliance and risk management has numerous benefits that must be addressed. By combining these two essential functions, businesses can reduce non-compliance risk and improve their overall risk profile.

- Enhanced Organizational Resilience: Integrating compliance and risk management enhances an organization’s ability to anticipate and respond to potential challenges effectively. A cohesive compliance and risk management approach helps organizations build adaptive capacities and navigate uncertainties more successfully.

- Improved Decision-Making: A data-driven approach to compliance and risk management leads to informed decision-making based on objective assessments and insights. Organizations can make better-informed choices by integrating compliance and risk data into strategic planning and decision-making processes.

- Stakeholder Trust and Confidence: Demonstrating commitment to compliance and risk management practices fosters stakeholder trust, attracting investors and customers who value responsible Conduct. Stakeholders are more likely to engage with organizations that prioritize governance, compliance, and risk management, which enhances their confidence in the organization’s stability and ethical behavior.

- Proactive Compliance Measures: Integrating compliance and risk management facilitates aggressive compliance efforts, reducing the risk of last-minute efforts to meet regulatory requirements. Organizations can stay ahead of compliance changes and proactively implement necessary adjustments to align with evolving regulations.

- Streamlined Processes: Integrating compliance and risk management eliminates duplications, streamlines processes, and optimizes resource utilization. By aligning these functions, organizations can streamline data collection, reporting, and analysis, resulting in more efficient use of resources.

Conclusion

Compliance and risk management are symbiotic disciplines that fortify organizations against potential threats while promoting ethical Conduct and responsible behavior. By identifying and addressing potential risks and ensuring adherence to laws and regulations, these two pillars form a robust foundation for organizational resilience.

Integrating compliance and risk management instills confidence in stakeholders, enhances decision-making, and fosters a culture of ethical Conduct and accountability. In today’s dynamic and complex business landscape, the cohesive relationship between compliance and risk management is essential for organizations striving to succeed with integrity and longevity. By embracing these interconnected practices, organizations can establish a solid framework for ethical behavior, long-term sustainability, and continued success in a rapidly evolving business environment.