Tax preparation and compliance are critical to running a business or managing personal finances. Navigating the complexities of tax laws, tracking deadlines, and efficiently managing client information can overwhelm accountants and tax professionals. This article explores Canopy, a comprehensive tax practice management software designed to revolutionize the way accountants and tax professionals handle their tax-related tasks.

What is Canopy?

Canopy is an all-in-one tax practice management software that simplifies and automates various tax preparation and practice management aspects. Developed specifically for accounting firms and tax professionals, Canopy offers a range of features and functionalities that streamline workflows, enhance collaboration, and provide valuable insights into clients’ tax situations.

To streamline tax practice management, professionals need advanced tools to automate workflows, centralize client data, and provide real-time insights. With Canopy, professionals can efficiently manage client data, track tasks and deadlines, automate tax compliance processes, and deliver high-quality service. Its user-friendly interface help professionals efficiently manage client data and automate tax-related tasks.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 85

-

Feature and Functionality - 90

-

Customer Support - 90

-

Setup and Integration - 80

-

Value of Money - 85

User Review

4.57 (23 votes)Key Features and Functionalities

Canopy offers many features and functionalities that transform tax practice management. Let’s explore some of its key offerings.

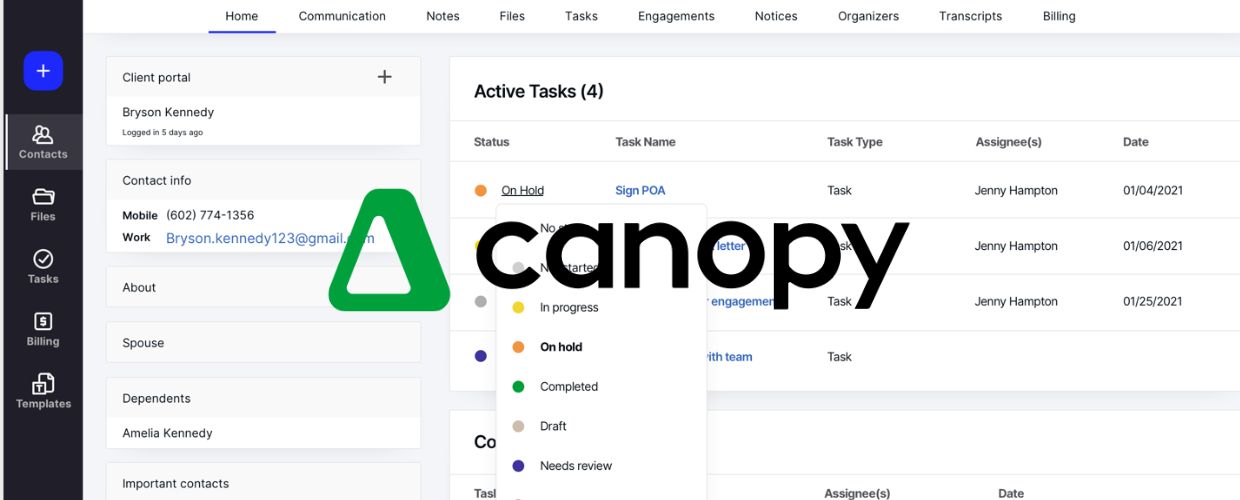

Client Management

Canopy provides a centralized hub for managing client data. Professionals can securely store client information, track engagement progress, and comprehensively overview each client’s tax-related details. This feature allows for efficient organization and easy access to client data when needed.

Task and Workflow Automation

The platform offers robust task management and automation features. Professionals can create customized workflows, assign tasks to team members, and track the progress of each job in real-time. By automating repetitive tasks, Canopy saves time and reduces the risk of errors, allowing professionals to focus on higher-value activities.

Document Management

Its document management system simplifies organizing and sharing tax-related documents. Professionals can securely store and share documents with clients, eliminating the need for physical paperwork and reducing administrative burdens. This feature ensures data security and enhances collaboration.

Tax Compliance

Canopy automates tax compliance processes, simplifying the preparation and filing of tax returns. The software stays up-to-date with tax regulations, calculates tax liabilities accurately, and generates tax forms and reports. It helps professionals meet tax deadlines and ensure compliance with ever-changing tax laws.

Real-time Analytics and Insights

The platform provides powerful analytics and reporting capabilities, allowing professionals to gain valuable insights into their clients’ tax situations. With real-time dashboards and reports, professionals can analyze tax data, identify trends, and provide proactive advice to their clients. This feature enables professionals to offer strategic guidance and optimize tax planning strategies.

Benefits of Canopy

Implementing Canopy can bring numerous benefits to accounting firms and tax professionals. Let’s explore some of these benefits:

Improved Efficiency and Productivity

By automating tasks, centralizing client data, and streamlining workflows, Canopy improves overall efficiency and productivity. Professionals can accomplish more in less time, allowing them to serve a more extensive client base and focus on providing high-quality tax services.

Enhanced Collaboration

Its collaborative features foster seamless communication and collaboration between professionals and their clients. Real-time data sharing, document management, and task assignment capabilities ensure all stakeholders are aligned and can work together effectively.

Increased Accuracy and Compliance

With Canopy’s automated tax compliance processes, professionals can minimize errors and ensure accurate tax calculations and filings. The software keeps track of tax deadlines, incorporates the latest tax regulations, and generates compliant tax forms, reducing the risk of penalties and audits.

Client Satisfaction and Retention

Its streamlined processes and real-time insights enable professionals to deliver exceptional client service. By providing timely and accurate tax advice, professionals can build stronger client relationships, enhance client satisfaction, and increase client retention rates.

Scalability and Growth

Canopy is designed to support the growth of accounting firms and tax practices. The software can accommodate a growing client base and adapt to changing business needs. As firms expand, the platform provides the flexibility and scalability to manage a larger volume of clients and complex tax scenarios.

Conclusion

Canopy is a game-changer in the world of tax practice management. By offering a comprehensive suite of features, including client management, task automation, document management, tax compliance, and real-time analytics, the platform empowers accounting firms and tax professionals to streamline workflows, enhance collaboration, and deliver exceptional service. By leveraging the power of Canopy, accounting firms and tax professionals can optimize their tax practice management, improve efficiency, and achieve tremendous success in their industry.