Managing payments and invoicing can be complex and time-consuming in the accounting world. This article explores CPACharge, its key features, and how it simplifies payment processing, enhances efficiency, and improves cash flow for accounting professionals.

What is CPACharge?

CPACharge is a leading payment processing solution for Certified Public Accountants (CPAs) and accounting professionals. It is a secure online payment processing platform tailored to CPAs’ and accounting professionals’ unique needs. Developed by professionals who understand the accounting industry, the platform provides a comprehensive solution for managing client payments, streamlining invoicing processes, and accepting credit card and ACH payments.

The platform offers a seamless and user-friendly experience, enabling accounting professionals to focus on their core responsibilities while leaving the payment processing tasks to a reliable and secure system. CPACharge complies with all major industry standards and regulations, ensuring the protection of sensitive client financial data and maintaining the highest level of security.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 85

-

Feature and Functionality - 85

-

Customer Support - 90

-

Setup and Integration - 85

-

Value of Money - 90

User Review

4.5 (22 votes)Key Features of CPACharge

CPACharge provides a range of features that simplify payment processing and enhance the overall client experience. Let’s explore some of its key offerings.

Online Payment Acceptance

The platform allows accounting professionals to accept online payments securely and conveniently. Clients can make payments directly from their computer or mobile device, eliminating the need for paper checks or manual processing. This feature streamlines the payment collection process and expedites cash flow.

Customizable Payment Pages

With CPACharge, accounting professionals can create personalized payment pages to align with their branding. The platform enables the customization of payment forms with logos, colors, and branding elements, providing clients with a consistent and professional experience.

Recurring Payments

It simplifies the process of managing recurring payments. Accounting professionals can set up automatic payment schedules for clients with recurring invoices, reducing the administrative burden and ensuring timely and consistent payment collection.

Payment Reminders

The platform offers automated payment reminder functionality, sending reminders to clients for outstanding invoices. This feature helps improve collection rates by gently reminding clients of their payment obligations, reducing the need for manual follow-ups.

Secure Data Storage

CPACharge prioritizes data security. The platform utilizes advanced encryption and tokenization technologies to secure client payment information. By storing client data securely, accounting professionals can ensure compliance with industry regulations and maintain the trust of their clients.

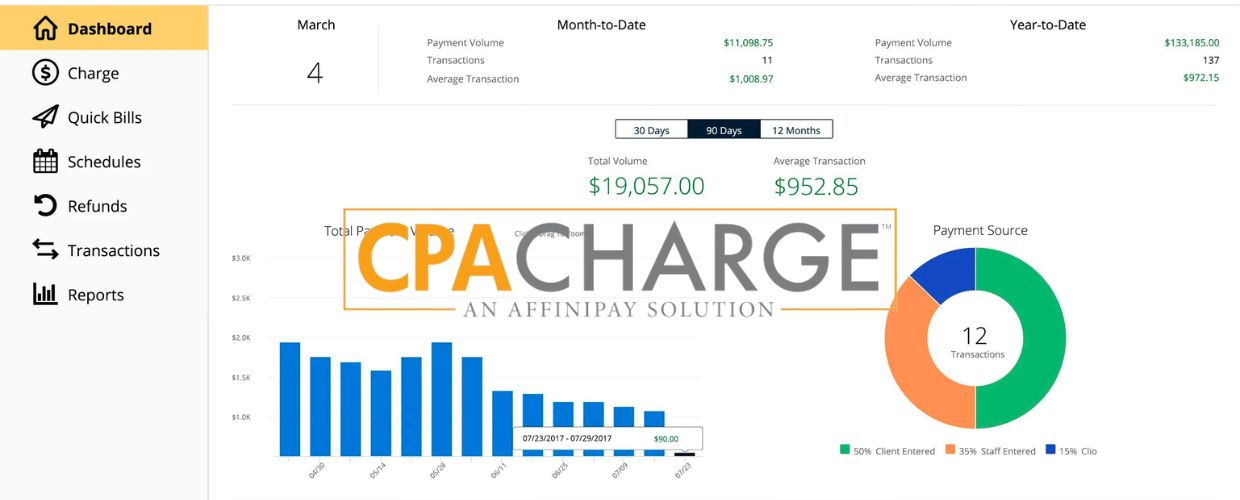

Reporting and Analytics

The platform provides robust reporting and analytics features, offering insights into payment trends, outstanding balances, and revenue streams. It lets accounting professionals view their financial performance and make data-driven decisions to optimize business operations.

Benefits of CPACharge

Implementing CPACharge offers numerous benefits for CPAs and accounting professionals. Let’s explore some of these benefits.

Improved Cash Flow

By accepting online payments, CPACharge accelerates the payment collection process, leading to improved cash flow for accounting professionals. Timely payments reduce the need for follow-ups and provide more predictable revenue streams.

Time and Resource Savings

The software platform automates payment processing tasks, saving accounting professionals valuable time and resources. The platform eliminates manual data entry, reduces administrative efforts, and enables more efficient payment management.

Enhanced Client Experience

The convenience of online payment options enhances the overall client experience. CPACharge’s user-friendly interface and secure payment methods provide clients with a seamless and hassle-free payment process, increasing client satisfaction and loyalty.

Increased Payment Security

With its adherence to industry standards and robust security measures, CPACharge ensures the secure handling of client payment data. Accounting professionals can instill confidence in their clients, knowing their financial information is protected.

Compliance with Industry Regulations

It complies with industry regulations like the Payment Card Industry Data Security Standard (PCI DSS). By using the software solution, accounting professionals can meet their compliance obligations and maintain the security and integrity of client financial data.

Streamlined Accounting Processes

By integrating with popular accounting software, such as QuickBooks, CPACharge streamlines accounting processes. The platform automatically syncs payment data with accounting systems, reducing manual data entry and ensuring accurate and up-to-date financial records.

Conclusion

CPACharge is a reliable payment processing solution tailored specifically for CPAs and accounting professionals. With its secure online payment acceptance, customizable payment pages, recurring payment capabilities, and robust reporting features, the platform simplifies payment processing, improves cash flow, and enhances the overall client experience. By implementing the software solution, accounting professionals can streamline payment collection processes, save time and resources, ensure compliance, and focus on delivering exceptional client services. With its commitment to security, convenience, and industry expertise, CPACharge is a valuable tool for accounting professionals seeking to optimize their payment processes and grow their practices.