Managing personal and business finances can be daunting, often requiring individuals to juggle multiple accounts, track expenses, and plan budgets. This article explores Uku, a robust and user-friendly platform designed to streamline financial tasks, enhance budgeting capabilities, and provide valuable insights into personal and business finances.

What is Uku?

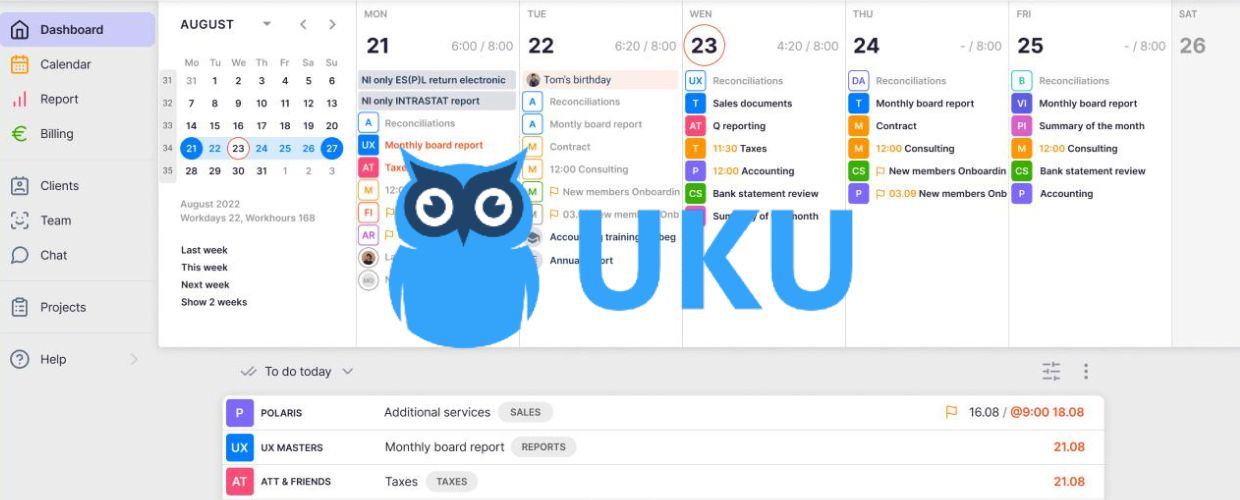

Uku is an all-in-one financial management platform that combines a wide range of features and functionalities to help individuals and businesses gain better control over their finances. It is the go-to solution for individuals and small businesses seeking an all-in-one financial management platform that promotes financial organization, efficiency, and success. With Uku, users can consolidate their financial accounts, track expenses, create budgets, generate reports, and analyze financial data in one place.

To simplify financial management and provide a comprehensive solution for individuals and businesses, Uku steps in as a versatile financial management platform. The platform offers a seamless and intuitive user interface, making it accessible to individuals and small businesses, regardless of their financial expertise.

Recommendations and Ratings

EXPERT RECOMMENDATIONS

Overall

-

Easy-of-Use - 90

-

Feature and Functionality - 90

-

Customer Support - 95

-

Setup and Integration - 85

-

Value of Money - 90

User Review

4.5 (24 votes)Key Features and Functionalities

Uku offers many features and functionalities that cater to the diverse needs of individuals and small businesses. Let’s delve into some of its key offerings.

Account Aggregation

The platform allows users to connect and aggregate their financial accounts, including bank accounts, credit cards, investments, and loans, in a single dashboard. This feature provides a holistic view of their economic landscape, enabling users to track balances, transactions, and net worth effortlessly.

Expense Tracking and Categorization

With Uku, users can easily track and categorize expenses based on customizable categories. The platform provides automated transaction categorization, reducing manual effort and ensuring accurate expense tracking. Users can set spending limits for different types, helping them stay within their budget and identify areas where adjustments may be necessary.

Budget Creation and Monitoring

It empowers users to create personalized budgets and track their progress in real-time. Users can set budget goals for various expense categories, receive alerts when nearing budget limits, and analyze spending patterns to make informed financial decisions. The platform’s budgeting features facilitate effective financial planning and assist users in achieving their savings goals.

Bill Payment Reminders

Uku simplifies bill management by providing timely payment reminders. Users can set up recurring bill payments, receive notifications before due dates, and avoid late payment fees. This feature ensures that bills are paid on time, reducing the risk of missed payments and improving overall financial organization.

Financial Reports and Insights

The platform generates comprehensive financial reports and offers valuable insights into spending habits, income trends, and overall financial health. Users can analyze their financial data through visualizations and graphs, helping them understand their financial patterns and make informed decisions. The platform’s reporting capabilities provide a clear overview of financial status and aid in long-term financial planning.

Collaboration and Sharing

For small businesses or shared financial responsibilities, Uku enables collaboration by allowing multiple users to access and contribute to financial accounts. This feature facilitates efficient teamwork, ensuring transparency and effective financial management among team members.

Benefits of Uku

Implementing Uku as a financial management platform offers several benefits for individuals and small businesses. Let’s explore some of these benefits.

Streamlined Financial Management

The software solution simplifies the complexity of managing multiple financial accounts by providing a centralized platform for tracking expenses, creating budgets, and analyzing financial data. Users can streamline their financial tasks, saving time and effort while gaining a clear understanding of their financial health.

Improved Budgeting and Financial Planning

By leveraging Uku’s budgeting features, individuals and small businesses can create realistic budgets, track expenses, and monitor progress in real-time. It leads to better financial planning, more accurate forecasting, and improved control over spending habits.

Enhanced Financial Insights

Its reporting capabilities and financial insights empower users to make informed decisions based on accurate financial data. Users can identify spending patterns, evaluate income sources, and adjust their financial strategies accordingly. The platform provides valuable insights for better financial decisions and long-term financial stability.

Financial Organization and Collaboration

Uku’s ability to aggregate and organize financial accounts simplifies financial organization and collaboration, particularly for small businesses. Multiple users can access and contribute to financial accounts, ensuring transparency, accuracy, and efficient teamwork.

Secure and Reliable Platform

The platform prioritizes data security and privacy. The platform employs advanced encryption protocols and strict security measures to protect users’ financial information. Users can trust that their financial data is secure and confidential.

Conclusion

Uku revolutionizes financial management by offering a comprehensive platform that simplifies personal and business finances. With its account aggregation, expense tracking, budgeting capabilities, bill payment reminders, financial reports, and collaboration features, the platform provides individuals and small businesses with the tools to control their finances, make informed decisions, and achieve financial goals. By implementing Uku, users can streamline financial tasks, improve budgeting, gain valuable insights, enhance collaboration, and ensure the security of their financial information.